Introduction

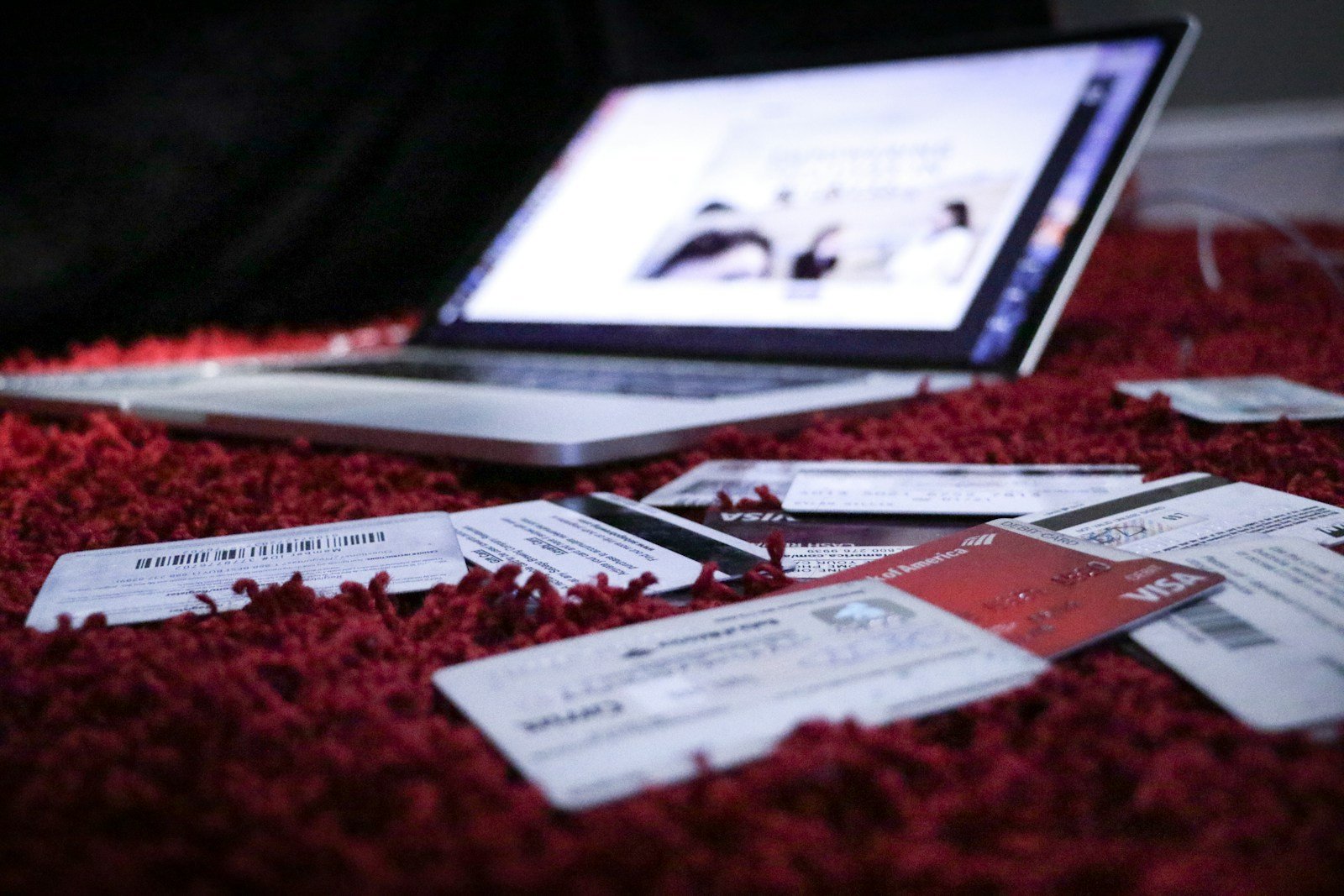

Debt can be a significant burden, weighing heavily on our financial well-being and personal lives. According to a 2021 report, the average American household carries over $155,000 in debt, including mortgages, credit cards, and student loans. While debt is sometimes unavoidable, it's crucial to have an effective strategy in place to pay it off efficiently. By taking control of your debt, you can alleviate financial stress, improve your credit score, and free up resources for other important goals.

Key Points to Cover

Understanding Your Debt: The First Step

Before embarking on your debt repayment journey, it's essential to understand the nature and extent of your debt. Start by listing all your debts, including credit cards, personal loans, student loans, and any other outstanding balances. Note the interest rates, minimum payments, and total amounts owed for each debt. This comprehensive overview will help you prioritize and develop an effective strategy.

Assess the Impact of Debt

Debt can have far-reaching consequences beyond just the financial burden. It can affect your credit score, limit your ability to secure loans or mortgages, and cause significant emotional stress. By understanding the full impact of debt, you'll be better motivated to take action and commit to a debt repayment plan.

The Debt Snowball Method

The debt snowball method, popularized by financial expert Dave Ramsey, is a psychological approach to debt repayment. It involves listing your debts from smallest to largest, regardless of interest rates, and focusing on paying off the smallest debt first. Once the smallest debt is paid off, you "snowball" the payment amount towards the next largest debt, and so on, until all debts are eliminated.

The Psychology of the Debt Snowball

The debt snowball method leverages the power of small wins and motivation. By paying off the smallest debt first, you experience a sense of accomplishment and momentum, which can propel you forward in your debt repayment journey. This psychological boost can be particularly effective for those who struggle with staying motivated when tackling larger debts.

The Debt Avalanche Method

The debt avalanche method, on the other hand, takes a more mathematical approach. It involves listing your debts from highest to lowest interest rate and focusing on paying off the debt with the highest interest rate first. This method prioritizes minimizing the overall interest paid, potentially saving you money in the long run.

The Math Behind the Debt Avalanche

By targeting the debt with the highest interest rate first, you’ll save more on interest charges over time. However, this method may not provide the same psychological boost as the debt snowball, as it can take longer to see tangible progress in eliminating individual debts. The decision between the two methods often comes down to personal preference and individual circumstances.

Budgeting and Debt Management

Effective budgeting is a crucial component of any successful debt repayment strategy. Start by tracking your income and expenses to identify areas where you can cut back and allocate more funds towards debt repayment. Consider using budgeting apps or tools to streamline the process and stay on top of your finances.

The Importance of Budgeting for Debt Repayment

Budgeting helps you prioritize debt repayment and ensures that you’re allocating sufficient funds towards your debt repayment goals. It also helps you identify areas where you can free up additional funds, such as reducing discretionary spending or finding ways to increase your income. By taking control of your budget, you’ll be better equipped to tackle your debt efficiently.

Debt Consolidation: A Potential Solution

Debt consolidation is a strategy that involves combining multiple debts into a single loan, often with a lower interest rate. This can simplify your payments and potentially save you money on interest charges. However, it’s important to carefully evaluate the terms and fees associated with debt consolidation options to ensure it’s the right choice for your situation.

The Pros and Cons of Debt Consolidation

Debt consolidation can be advantageous if you can secure a lower interest rate and streamline your payments. However, it’s important to exercise caution and ensure that you don’t incur additional debt or extend the repayment period unnecessarily. Additionally, some debt consolidation options may negatively impact your credit score, so it’s essential to weigh the potential benefits and drawbacks carefully.

Additional Resources and Further Reading

- Debt.org – A comprehensive resource for debt education and management

- NerdWallet: Strategies to Pay Off Debt

- Investopedia: Understanding Debt Consolidation

- Dave Ramsey’s Debt Snowball Method

Practical Tips and Actionable Advice

-

Create a Debt Repayment Plan

Start by listing all your debts, interest rates, and minimum payments. Decide on a repayment strategy, whether it’s the debt snowball or debt avalanche method, and create a realistic plan to tackle your debts systematically.

-

Automate Your Payments

Set up automatic payments for your debt repayments to ensure that you never miss a payment. This can help you avoid late fees and potential damage to your credit score.

-

Negotiate with Creditors

If you’re struggling to make payments, consider reaching out to your creditors to discuss potentially lowering interest rates or setting up a more manageable payment plan. Many creditors are willing to work with you if you communicate proactively.

-

Increase Your Income

Look for ways to boost your income, such as taking on a side gig or freelance work. Allocate any additional income towards your debt repayment efforts to accelerate the process.

-

Celebrate Small Wins

Paying off debt can be a long and challenging journey. Celebrate small milestones along the way, such as paying off a credit card or reaching a certain debt reduction goal. These small wins will help keep you motivated and focused on your larger objectives.

Conclusion

Paying off debt efficiently requires a comprehensive strategy, discipline, and perseverance. By understanding your debt, implementing budgeting techniques, and leveraging effective repayment methods like the debt snowball or debt avalanche, you can take control of your finances and work towards a debt-free future.

Remember, the journey to becoming debt-free may not be easy, but the long-term benefits of financial freedom and peace of mind make it a worthwhile endeavor. Stay committed to your debt repayment plan, and don’t hesitate to seek support or professional advice if you need it.

Are you ready to take the first step towards a debt-free life? Share your thoughts and experiences in the comments below, and let’s embark on this journey together.